Air cargo industry anticipates big peak season to finish year7 Comments9 September 2024

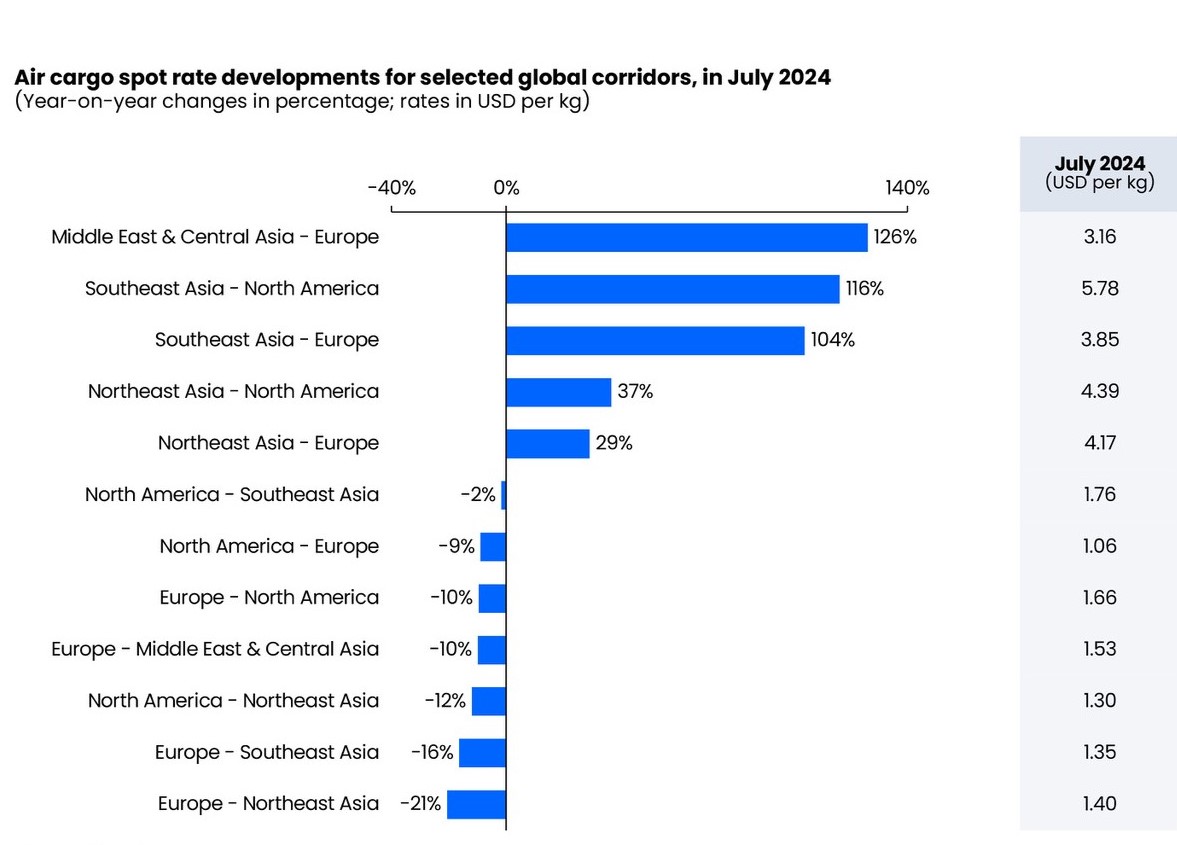

Logistics professionals and analysts expect the air cargo market’s remarkably strong first half to build momentum during the final months of the year, when international shipping normally peaks to meet holiday shopping demand, leading to pressure on capacity and higher rates. E-commerce volumes out of Asia continue to be a driving force behind growth, but other factors are also positively influencing air shipping. Although many U.S. and European businesses pre-ordered inventory to avoid being impacted by supply chain constraints, such as vessel rerouting around the Red Sea conflict zone, industry consensus is that underlying demand will translate into more transport activity. Still, a scenario in which fall orders were simply moved up by several months, effectively frontloading at the expense of upcoming volumes, can’t be ruled out. And mixed macroeconomic signals still have economists questioning the endurance of consumer spending. “I think you’re going to see the trend continuing. There is going to be an increase in volumes [while widebody freighter capacity is constrained] and rates are going to be affected as a consequence,” Atlas Air CEO Michael Steen said in a video interview. He predicted the high demand situation with limited supply will extend into 2025 and beyond. FedEx and UPS peak-season surcharges that are pricier than in previous years are an indicator the integrated parcel carriers expect heavy domestic and international volumes during the holiday stretch run. UPS management said in its recent earnings call that it anticipates record-high parcel volumes in December. Hong Kong-based airline Cathay Pacific recently said it also expects strong demand over peak season. Airfreight demand increased 13% year over year in July behind the persistent e-commerce volumes from China and ocean substitution, during what is typically a slow season for air cargo, according to freight market analytics firm Xeneta. Volumes have increased by double digits for eight consecutive months. The market’s performance is partly influenced by the fact that July 2023 volumes were relatively weak. Meanwhile, the supply of cargo space grew at a slower 2% rate, leading to tight capacity on certain trade lanes. The load factor, a measure of capacity utilization, increased five points to 59% as demand growth exceeded that of supply. Lagging data from the International Air Transport Association showed air cargo traffic in June rose 14% from 2023, closely tracking Xeneta’s findings. The airline group, which uses a different measurement methodology, said demand in the first half was up 13.4% from a year ago, 4.3% better than the same period in 2022 and equivalent to shipment levels during the pandemic-fueled surge of 2021. At the same time, June marked more than three years of double-digit annual capacity growth, mostly from passenger airlines adding flights that can also accommodate shipments. Belly space was up 16.8% compared to more modest growth of 4.1% in freighter capacity. Flight hours for dedicated freighters increased 3% year over year in July, an improvement from June and in line with May, but above the negative readings between February and April, according to research from BMO Capital Markets. The increased e-commerce demand has led to a shortage of widebody freighters, which are now fully booked through the end of the year, Taiwan-based logistics provider Dimerco Express said in its latest monthly update. Airlines have responded by splitting their block space agreements with forwarders into smaller segments, particularly on the China to U.S. route. Global average spot rates reached $2.64 per kilogram earlier this month, close to the high for the year and roughly on par from the same time last year. Since then rates have cooled slightly, but are still about 11% higher than a year ago and even higher versus pre-pandemic levels. Rates on routes out of the Asia Pacific gird the global average. Shipping rates from Shanghai to North America, for example, rose more than 25% compared to the same month last year, while rates to Europe increased by 44%, according to the TAC Index.

Airfreight prices out of China/Hong Kong were well above typical summer rate levels at about $5.72 from Hong Kong to North America at the end of July and $4.50 to Europe, and are expected to climb above peak-season norms in the fourth quarter, according to Judah Levine, head of research at Freightos. Cargo revenue at several passenger and combination carriers grew year over year in the second quarter for the first time in a year. Asiana, All Nippon Airways, Lufthansa, Delta Air Lines, Korean Air and United Airlines boosted revenue by 12% to 16% during the period, while other airlines saw smaller declines than in previous quarters. Shippers and freight forwarders in the Northeast Asia to Europe market are feeling the price squeeze with aircraft nearly 90% full each flight, according to Xeneta. Load factors on the backhaul are only 43%, down 18 points from 2019 levels – which explains why fronthaul rates are three times higher than the return leg. Forwarders are passing on high rates to customers signing long-term contracts, with base rates up 30% year over year to $4.42/kg. But when logistics companies commit to space on terms valid for less than a month they are paying 40% more than a year ago. Airlines are still making more money per flight operating out of Asia instead of other markets, even with the imbalance in fronthaul and backhaul rates, Xeneta pointed out. Seattle-based forwarder Expeditors underscored the situation in its second-quarter report, saying that the amount of air tonnage it managed for customers increased 15% year over year, “but buy rates outpaced increased sell rates, as international direct e-commerce demand from North Asia outweighed increased carrier capacity to accommodate this growth in demand.” International e-commerce from Asia is growing by leaps and bounds and leaning heavily on airfreight to get parcels to consumers. E-commerce now accounts for one-fifth of air freight volume, a share that continues to increase annually. Canadian freighter airline Cargojet said in earnings news that “cooling inflation and continued interest rate reductions are leading to increased discretionary consumer spending especially on e-commerce services. Early signals in the market … are indicating that there could be a strong finish to the year.” Cargojet recently began operating three flights per week from Hangzhou, China, to Vancouver for Great Vision HK Express, which provides logistics services to e-commerce retailers in China. High rates in the Asia Pacific region are motivating some freighter operators to shift aircraft away from transatlantic service, where passenger airlines have flooded the market with capacity. Air France-KLM Group, citing demand from e-commerce platforms, said it will suspend several routes to Latin America next month to free up Boeing 747 cargo jets for service to Hong Kong. Lufthansa Cargo and Cargolux have notified customers that they will also reallocate some freighter capacity to Asia, starting in November, in response to the e-commerce boom and more lucrative rates. Latam Cargo will add two weekly freighter flights between Europe and Latin America, starting Oct. 1. Atlas Air on Thursday announced it has leased three Boeing 747-8 freighters from BOC Aviation to meet strong e-commerce demand, and expects them to enter service late in the third quarter. The New York-based cargo airline is benefitting from cross-border online sales “because we are the largest supplier to the growing e-commerce companies, so that’s something that’s definitely going to be positive for the fourth quarter,” Steen said. Atlas Air operates many dedicated flights per week for Chinese platforms Shein and Temu, as well as Cainiao, the logistics arm of Chinese e-commerce giant Alibaba Group; YunExpress, and express delivery company SF Group. The airfreight market is also getting a push from expansion of global manufacturing, with factory output in the U.S. and Asia stronger than Europe, and export orders. Some airlines and logistics providers say they are seeing solid air volumes across a range of products, in addition to e-commerce. Global logistics giant DSV said in a recent market update that it is seeing strength from traditional users of air transport, such as automotive and technology. “We’re seeing very strong demand from the fashion industry. We’ve been given a heads-up that this will be one of the heaviest fashion peak seasons in years. In part this is because of the Red Sea situation, which has gone on longer than expected. A lot of fashion is produced in the Indian subcontinent, and for a ship to go all around Africa adds a big increase in transit times,” said Jans Kleine-Lasthues, chief operating officer airfreight, at Germany-based Hellman Worldwide Logistics, in Cathay Cargo’s quarterly magazine. Container backlogs at the Port of Chittagong and the slow restart of garment factories following protests that toppled the government of Bangladesh have pushed some exports to air cargo providers as retailers try to recover from shipment delays. Airfreight costs to Europe tripled with the Dhaka airport still overloaded. Many exporters are trying to ship via airports in India or sea-air moves through Sri Lanka and Dubai to meet deadlines, UPS Supply Chain Solutions said in a customer note. Amber light? There are other question marks too about how long the surge in air cargo can last. July’s Purchasing Managers’ Index shows contraction in U.S. manufacturing across all major industries. The downturn is driven by soft demand, with businesses cautious about capital investments due to the uncertain economic and political environment in an election year. Many shippers this year moved up order times to make sure inventory for the holidays wasn’t late because of Red Sea-related delays. Others acted to avoid disruption from looming dockworker strikes along the U.S. East and Gulf coasts, and in Hamburg, Germany, or get goods imported before the U.S. government rolls out new tariffs. Whether the early peak season takes away from peak season demand remains to be seen. Some warn a prolonged port strike could strain a busy U.S. airfreight network if shippers shift modes for urgent commodities. Airfreight prices out of South Asia and the Middle East to North America and Europe have tapered off in recent weeks after remaining highly elevated since April, potentially reflecting reduced demand as ocean congestion eases and volumes shift from air back to ocean. Rates on the Shanghai to Europe trade lane dropped 10% month over month in July, but still remained 34% higher than a year ago, according to the Baltic Air Index. Rates from China to the United States have also dipped, but are still at levels typically only seen during the fourth-quarter peak season because of strong e-commerce volumes. And there are indications that forwarder spot market buy rates have peaked after cargo volume on the Northeast Asia to Europe corridor peaked in mid-June, Xeneta said in a recent blog post. The cooling off dovetails with developments in container shipping where spot rates ticked down 2% in August after peaking in late July. Meanwhile, the U.S. economy appears to be cooling and European consumer spending remains soft, despite lower inflation. The upward trajectory in export orders has tapered off. If demand is less deeply rooted than previously thought it could mean slower growth for air cargo, “but perhaps continued geopolitical unrest, strong low-value e-commerce demand, an early Chinese New Year in 2025 might be enough to keep air cargo rates high,” Xeneta surmised. While e-commerce remains a source of positive momentum for airfreight, “with continued oversupply in the global industry, a broader recovery in air freight (in particular, industrial) demand is needed for a sustained inflection point in the cycle,” said BMO Capital Markets analyst Fadi Chamoun in a recent research note. By: Eric Kulisch |

|

|